Looks likely

Canada’s economy is showing excellent signs fo improvement and the last jobs report has shown that the jobs market is nearly back to pr-pandemic levels.

Jobs galore

The jobs print was a mixed picture, but definitely tilted to the bullish side. Yes, the headline print was strong, coming in above expectations at 230K and the unemployment rate was pretty much on the button at 7.9%, but this was down on the prior reading of 8.2%. The majority of the jobs were part time that were added and full time jobs actually dropped by 33K. However the participation rate rose showing that more of the possible Canadian labour force is in the labour market. Good news.

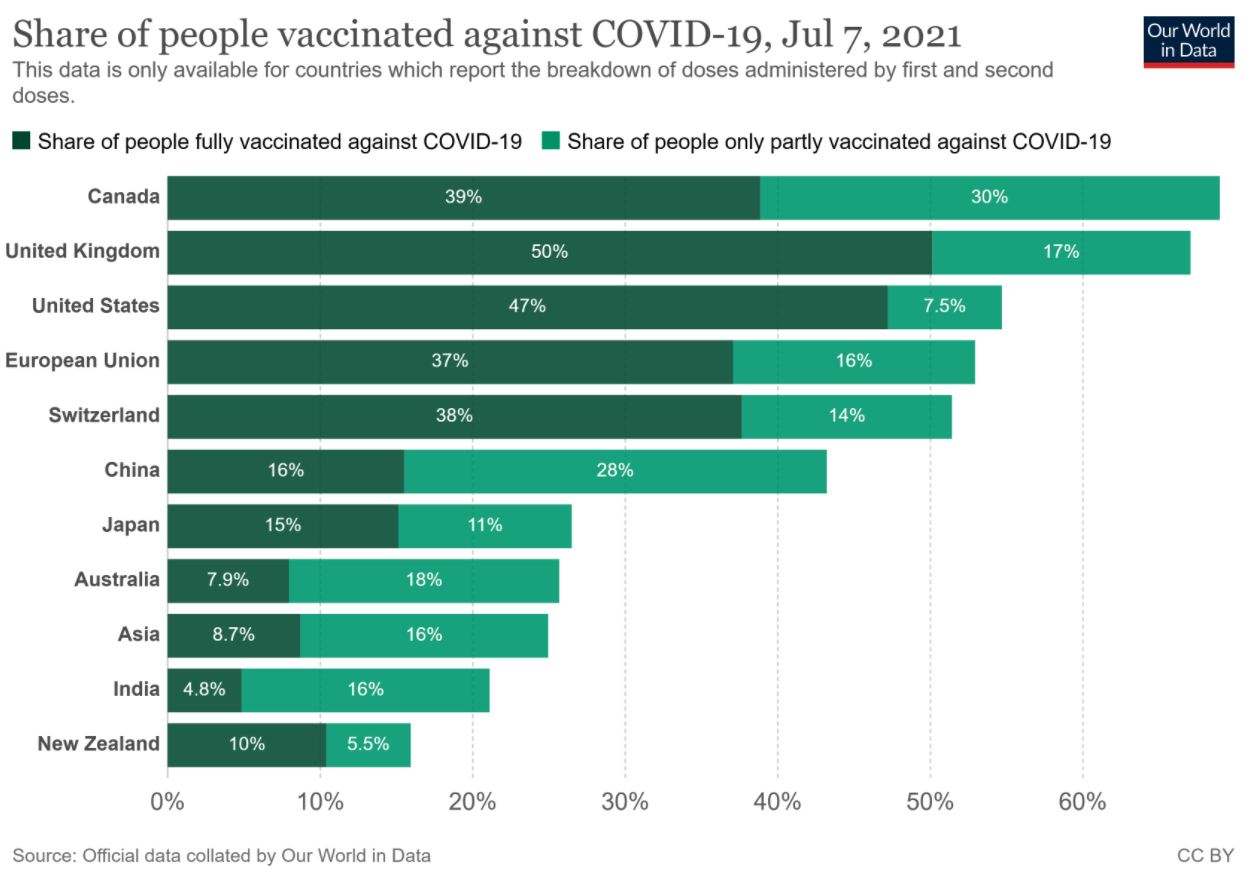

Canada’s vaccination rate

Canada’s rate of vaccination is high and half of the population will soon be fully vaccinated.

This has led to optimism reflected in the last BoC’s business outlook survey. Companies have plans to invest and hire staff and expect an increase in sales. The majority if Canadian firms now expect the impact of the pandemic to be behind them,

You can read the full report here from the BoC.

BoC to taper and CAD to gain

This sets up further tapering by the BoC on Wednesday and a potential further bias for more CADJPY gains on a bullish BoC as they taper further. The last BoC meeting was a ‘holding one’. The pace in tapering can now be picked up as the economy does not need so much bond buying. If the tapering agreed is a cut of more than the $1 billion per week then expect CAD strength out of the meeting. The only issue is that if the risk tone sours watch out for sudden gains in the JPY like we saw last week.