USD moves higher vs those pairs

The USD has moved to new session highs vs the EUR, JPY and CHF.

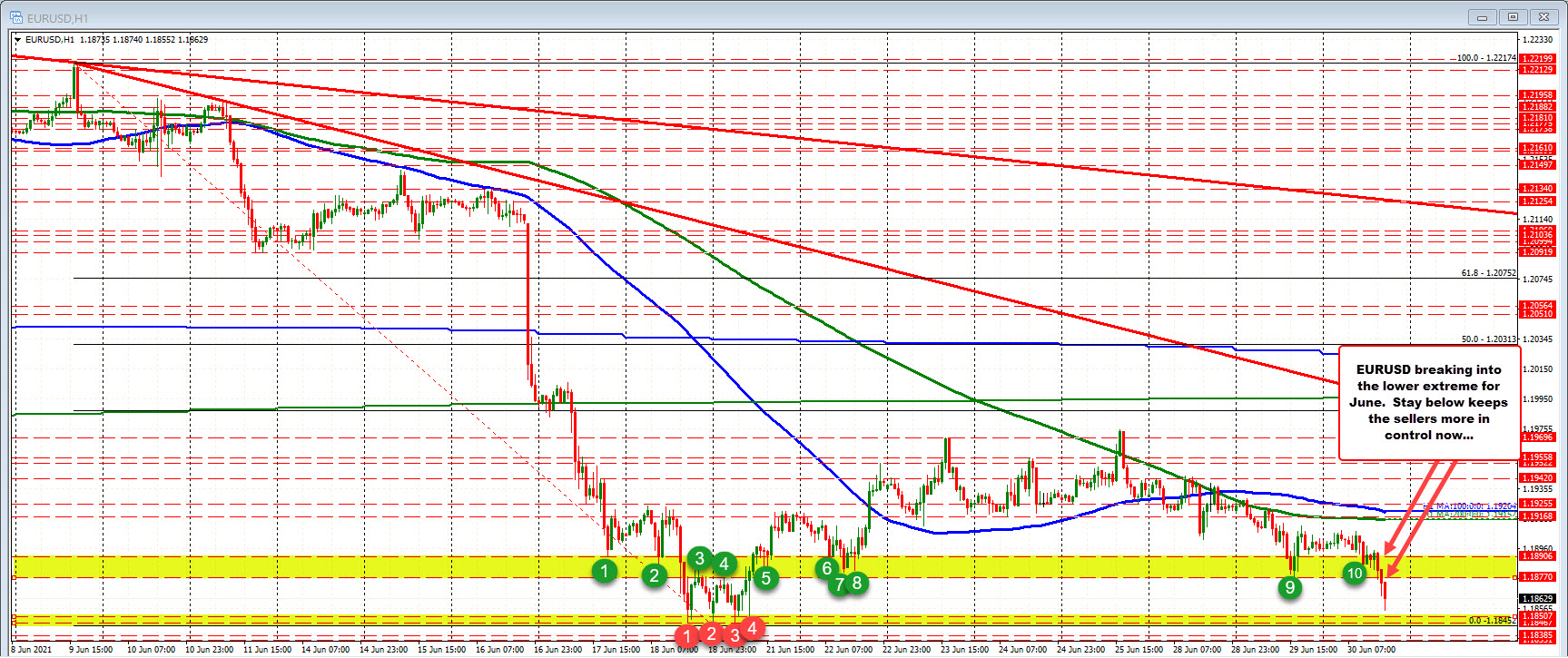

EURUSD: The EURUSD finally showed some additional downside momentum and has increased the day’s trading range in the process, the range is up to a more respectable 53 pips (was only 26 pips at the start of the NY session). The average over the last 22 trading days (about a month of trading), is 65 pips. The low has reached 1.18552 so far. The swing lows from June 18 to June 21 come between 1.18452 to 1.18507.

USDJPY: The USDJPY is up testing the topside trend line on the hourly chart. The high for the week at 110.978 would be the next target on a break to the upside. Earlier the price moved above the 200 and then 100 hour MAs (green and blue lines) as buyers retook control from a bearish tilt earlier in the day (below the MAs).

Close risk for the pair is now between 0.9231 and 0.92385 (see hourly chart below). That represents the swing highs going back to June 18 (see red numbered circles).