Big fall today and down for the week

The major European indices are ending the week on a sour note with big declines on the day. For the week the indices are also lower.

Looking at the provisional closes:

- German DAX -1.9%

- France’s CAC -1.5%

- UK’s FTSE 100 -2.0%

- Spain’s Ibex -1.9%

- Italy’s FTSE MIB -1.8%

For the week, the indices are all in the red:

- German DAX, -1.65%

- France’s CAC -0.5%

- UK’s FTSE 100 -1.65%

- Spain’s Ibex -2%

- Italy’s FTSE MIB -1.8%

A look around the markets as London/European traders look to exit shows:

- Spot gold up to dollars and $0.50 or +0.13% at $1775.62.

- Spot silver is up $0.10 or 0.4% $26 even

- WTI crude oil futures are rebounding and currently up around $0.96 or 1.35% at $72 even. The high price reached $72.17. The low extended to $70.16

- Bitcoin is down $-1300 or -3.45% at $36,437. The low price reached $36,366. The hi was up at $38,240

in the US stock market, the major indices are down sharply with the Dow industrial average leading the way.

- S&P index -48 points or -1.4% at 4173.63

- NASDAQ index -136 points or -0.96% at 14025.65

- Dow is down -472 points or -1.4% at 33352.

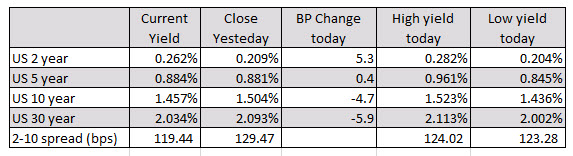

In the US debt market, the yields are mixed with a flatter yield curve as traders exit the shorter end (pushing up yields on Fed hikes sooner than expected). The longer and is down as the market prepares for the economy slowing because of the Fed hikes.

In the European equity market, the benchmark 10 year yields are mixed with flight to safety flows into the German, France, UK debt (yields lower), and flights out of risk in the Spain, Italy, and Portugal notes (yields higher):

The USD remains the strongest of the major currencies (and moving higher) followed closely by the JPY. Fed’s Bullard’s comments have been the big catalyst for a higher dollar (more hawkish in his interview on CNBC). The NZD is the weakest followed by the other commodity currencies including CAD and AUD.