The Day After (the FOMC)

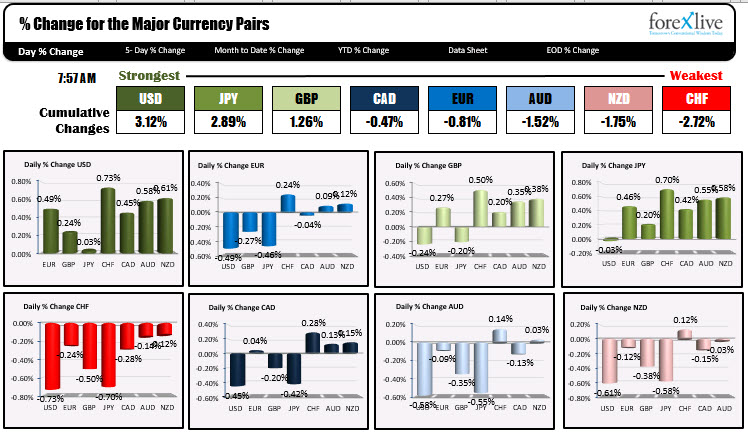

The day after the FOMC meeting has the USD as the strongest of the major currencies, while the CHF is the weakest as the North American session gets underway. Yesterday the dollar move sharply higher after the FOMC meeting where the fed dot plot showed more officials (7 vs 4) expect rates to rise in 2022 (although Chair Powell does discount the dot plot). The Fed is thinking about thinking about tampering (that is now in the rear view mirror). The central tendencies showed much stronger growth in 2021 and higher inflation as well, but they do see growth and inflation going back down in 2022 (first time since January). Stocks are down across the board with the Dow down for the 4th consecutive day. Yields moved up yesterday, but are lower today. Gold has moved below $1800 today. Crude oil is trading near $72 after peaking near $73 yesterday. Initial jobless claims, Philadelphia Fed business index and leading index will be released today. In Canada international security transactions and the home price index will also be released.

Looking at the ranges and changes, apart from the USJPY, the other pairs have solid ranges with the USD near the highs for the day. The trend move higher in the dollar continues after a lot of the pairs non trended for a number of days. The shove was given and the dollar is moving higher.

- Spot gold is down $-23.40 or -1.29% at $1787.80 after closing near $1800 yesterday. The high price today reached $1825.39. The low has reached $1785.86

- Spot silver is down $0.55 or -2.06% $26.43

- WTI crude oil is up down $0.15 or -0.21% at $71.98. The high price reached $72.29. The low price extended to $71.33

- Bitcoin is trading up $625 or 1.62% at $39,170

In the premarket for US stocks, the major indices are lower across the board. The Dow industrial average is down for the fourth consecutive day. The S&P and Dow had their worst day in over a month yesterday

- Dow is down -82.67 point, after yesterday’s 265.66 point decline

- S&P is down -11 points, after yesterday’s -22.89 point decline you’re an ass hole

- NASDAQ index is down -55 points after yesterday’s -33.18 point decline

In the European equity markets, the major indices are trading mixed

- German DAX, unchanged

- France’s CAC, Unchanged

- UK’s FTSE 100, -0.5%

- Spain’s Ibex, +0.1%

- Italy’s FTSE MIB, -0.17%

In the US debt market, the yields are modestly lower after yesterday’s sharp move higher. The 10 yield which was trading just below the 1.5% level before the FOMC decision is currently trading at 1.572%. The high yield reach 1.591% today. The high for the cycle in 2021 reach 1.774% back in March.

In the European debt market, the benchmark 10 year yields are higher across the board. The German 10 yield is down to -0.161% (the low yield went to -0.151%)