Dollar selling takes the pair back to the downside

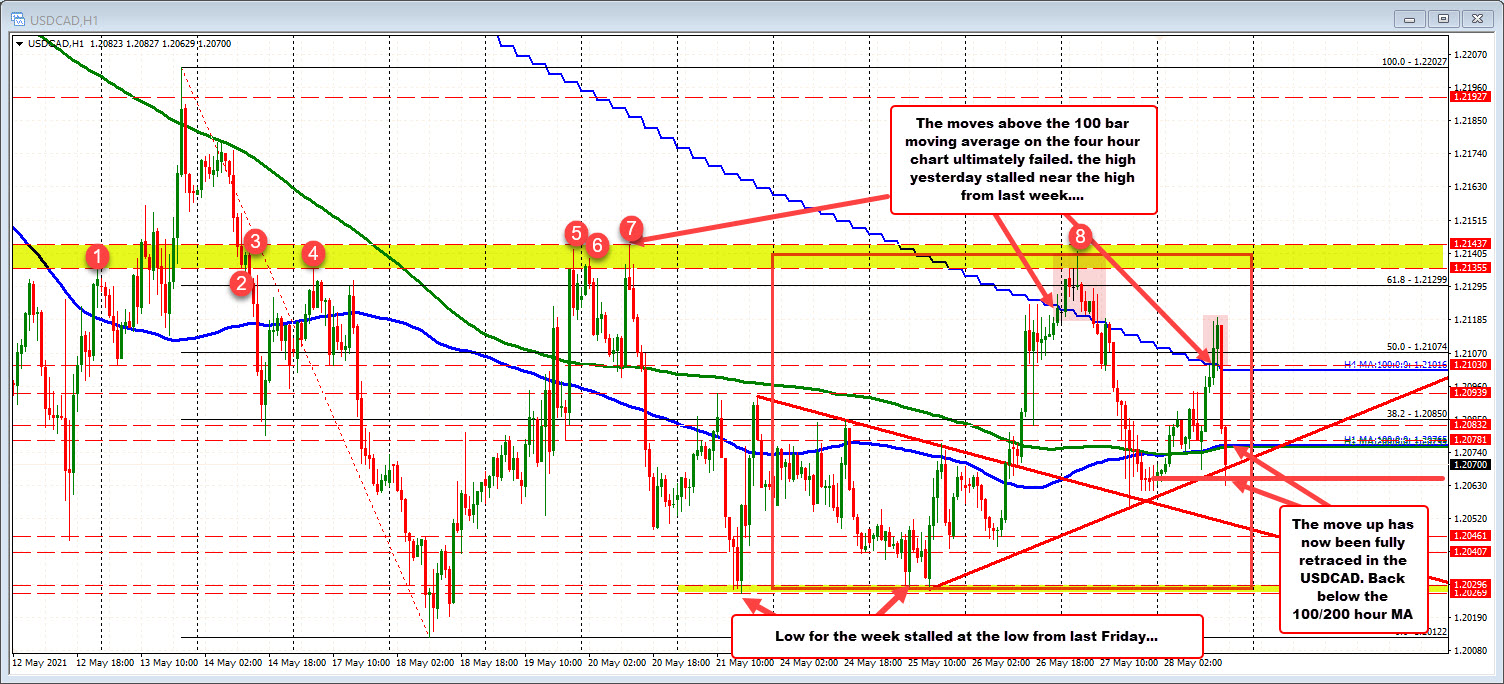

The USDCAD and retraced all its gains from the day. The low from the first hour of trading in the Asian session reach 1.20635. The price just dipped to a new session low for the day at 1.20629. All the declines have occurred in the last 2+ hours of trading as dollar buyers turned to dollars sellers in volatile end of month trading.

Technically, the price just moved back below its 100 and 200 hour moving averages which are converged at 1.2076. I wish I could say that the moving averages are now resistance with a little more confidence. However with month end seemingly having an influence, anything is possible. It is more about the flows today. Moreover, traders maybe more interested in exiting for the long weekend in both London and the US. That may also lead to randomness from the lack of liquidity.

For the week, the lows were reached on Tuesday when the price tested the low from Friday near 1.20269. The high for the week was reached yesterday as the price tested the high from last week near 1.21437 (the high for the week reached 1.2141).

The price this week did extend above its 100 bar moving average on the four hour chart (currently at 1.21016) on Thursday. That break was the first since April 21.

Today the price moved above that moving average for the second time, and tried to stay above it, but when the price dipped back below, the buyers turned sellers on the selling intensified. On the downside, the low from yesterday at 1.2255 would be the next downside target. Below that a swing area between 1.2040 and 1.2046 would be eyed