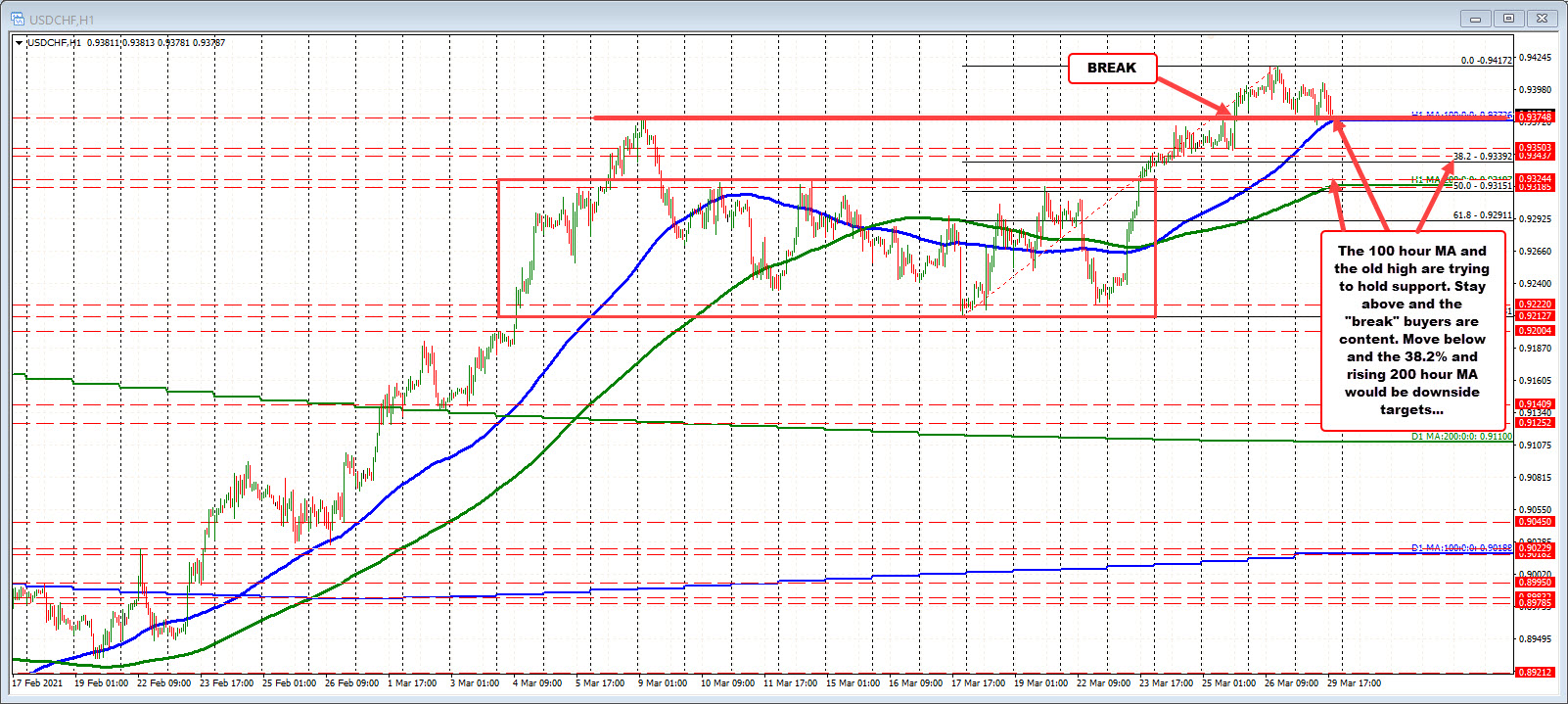

Can the buyers stay above 100 hour MA/old year high from earlier this month.

The USDCHF broke above the March 9 high at 0.93748 (and the highest level going back to July 2020), on Thursday last week, and stayed above that level on Friday. The high reached to 0.94172, before selling back off into the close.

Today, the price did dip below that old high at 0.93748 to a low at 0.9370, BUT did stay above the rising 100 hour MA.

Now the MA is getting close to the old high, increasing the levels importance. Traders who bought the break to new highs, would want to see the 100 hour MA and the old high hold support. Stay above and the buyers are content. Move below with more acceptance below the levels, and traders will shift the short term bias to the downside. Prepare for a rotation back to test the 38.2% of the last move higher and perhaps back down to retest the rising 200 hour MA.

For now, buyers are holding support. We will see if that bias can continue.