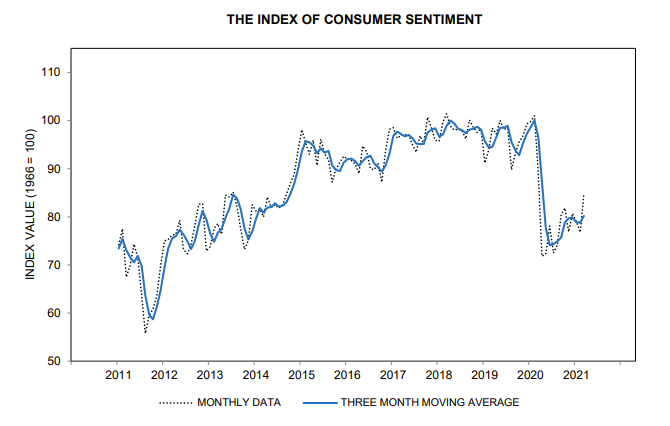

Preliminary estimate was 83.0

- Consumer sentiment 84.9 versus 83.6 estimate. Preliminary estimate was 83.0. Last month 76.8. Highest level since March 2020

- Current conditions 93.0 versus 91.5 preliminary. Index is up from February’s 86.2. level is the highest level since March 2020

- Expectations 79.7 versus 77.5 preliminary. Index is up from February’s 70.7. Level is the highest since March 2020

- 1 year inflation 3.1%. Unchanged from the preliminary estimate. The range going back to March 2020 is from 2.1% to 3.3%.

- 5-10 year inflation expectations 2.8% vs 2.7% in the preliminary report. The range going back to March 2020 is from 2.5% to 2.8%.

The index is on the rebound with components at the highest post covid levels but still below the pre-covid levels which were above and below the 100 level.

AS per the Univ. of Michigan:

Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress. As prospects for obtaining vaccination have grown, so too has people’s impatience with isolation, as those concerns were voiced by nearly one-third of consumers in March, the highest level in the past year. The majority of consumers reported hearing of recent gains in the national economy, mainly net job gains. The data clearly point toward robust increases in consumer spending. The ultimate strength and duration of the spending surge will depend on the rate of draw-downs in savings since consumers anticipate a slower pace of income growth. Despite the vast decline in precautionary motives sparked by the easing of pandemic fears, those precautionary motives will not completely disappear.