Markets:

- Gold down $1 to $1928

- US 10-year yields up 2.5 bps to 3.51%

- WTI crude oil down $1.63 to $79.37

- S&P 500 up 0.25% to 4070

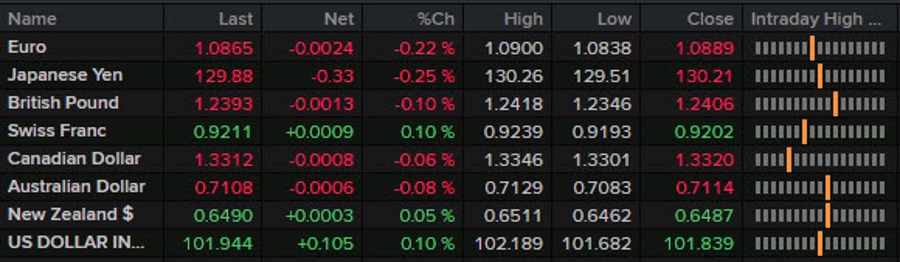

- JPY leads, EUR lags

The week is winding down and FX is largely flat on the day. There was some USD buying into the London fix but it reversed in the hour following and then the market coasted sideways to the finish with the market turning its gaze towards next week’s big central bank decisions (Fed, ECB and BOE).

EUR/USD touched a low of 1.0836 into the fix but bounced 30 pips from there to finish the week largely flat. Cable was similar with a fall to 1.2345 to match yesterday’s low (also at the fix) before a bounce to 1.2398 late. It was also flat on the week as it consolidates below 1.2400.

USD/JPY continues to consolidate just off the bottom of the January low. JPG yields tested 0.50% today for the first time since the BOJ decision in a sign that the squeeze is over. The range was narrow this week and the market is likely to go with the next break in the pair.

Commodity currencies largely traded sideways on the day, which was a bit of surprise given the reversal and decline in oil. CAD finished slightly higher on the day but there were some warning signs with selling in copper and some China-related markets.

I’m going to start asking ChatGPT to write Friday poems that summarize the mood of the market.

Meme stocks, oh how they soar,

Like a cat playing with a door,

Retail investors, they flock,

To buy in, like a rooster on a rock.

Gamestop, AMC, and more,

The memes they’re worth fighting for,

But watch out, don’t get too caught,

The market’s a roller coaster, it’s hot.

Redditors, they hold the key,

To memes that will make you glee,

But beware, it’s not always sunny,

Meme stocks can make you feel like a dummy.

So hold on to your wallets tight,

And don’t believe in everything that’s bright,

In the world of memes, it’s all a game,

Just remember to always do your own research, and don’t be lame.