With the US traders returning from the Thanksgiving Day holiday for an abbreviated session and the World Cup going on, the day was set up to be somewhat limited.

The USD did move higher in early NA trading. However, as debt market rates ticked higher partly in reaction to a move higher in European rates so sent the greenback even higher. The German 10 year moved up about 12 basis points on the day. Spain moved up 15 bps, and France up 13.7 bps.

The US rate move was less, however, and then rates started to come back down. Lo and behold the EURUSD moved higher.

Technically, the run back to the upside was helped by a bounce off the near converged 100/200 hour MAs near 1.0359 (the low reached 1.0360). The move off the low was able to extend back above the 200 day MA at 1.03877, and is looking to close above that key moving average, giving the pair a positive, bullish bias into the new trading week (on Monday). The price is trading at 1.1402.

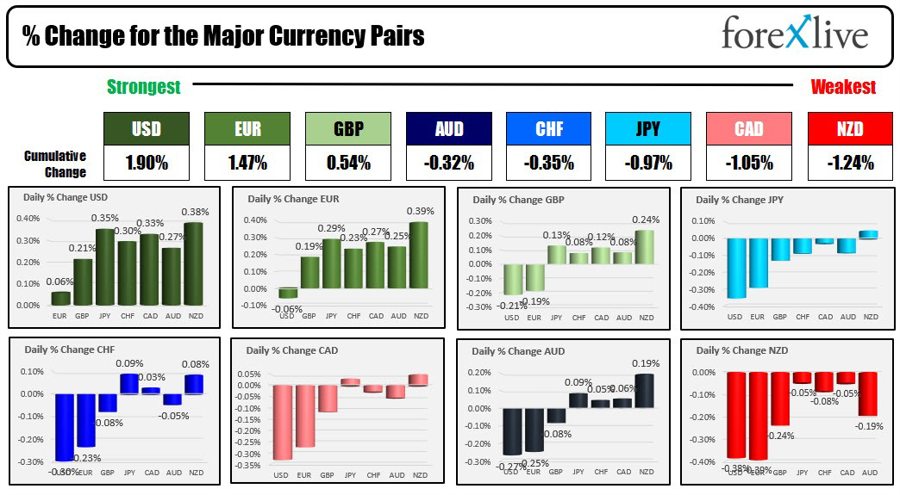

For other pairs, the greenback moved a bit lower in the NY session, but held onto to most of the NY early gains. Apart from the EURUSD where the dollar rose by a small 0.06%, the gains were the other currencies were between 0.21% to 0.38%. The dollar rose the most against the NZD at 0.38%.

In other markets, US stocks closed mixed with the S&P snapping 2 day moves higher. The Dow rose however led by Boing (up 3.53%), Home Depot (up 1.66% and UnitedHealth (up 1.51%).

- Spot gold is near unchanged at $1753.50.

- Silver is down -$0.07 at $21.42

- Crude oil is back below $77.00 at $76.53

- Bitcoin is little changed from $16500 near the open of US hours at $16472.

Thank you for your support. Hope you have a great weekend.