This earlier on dollar implications of the CPI from Morgan Stanley:

The data is due at 1230 GMT:

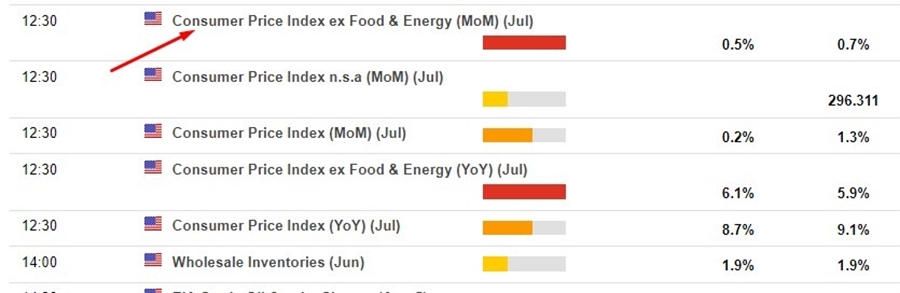

This

snapshot from the ForexLive economic data calendar, access

it here.

The

times in the left-most column are GMT.

The

numbers in the right-most column are the ‘prior’ (previous

month/quarter as the case may be) result. The number in the column

next to that, where is a number, is the consensus median expected.

Via BNZ, what to watch:

- The consensus expects headline inflation of just 0.2% m/m, the lowest in 18-months, helped by lower gasoline and food prices.

- But a core CPI measure of 0.5% m/m would remain too high for comfort.

- A stronger result would increase the chance of another 75bps hike next month and boost the USD, while a very weak result would increase the chance of a shift down to 50bps and a weaker USD on the day.

This article was originally published by Forexlive.com. Read the original article here.