Tentative moves in the markets today

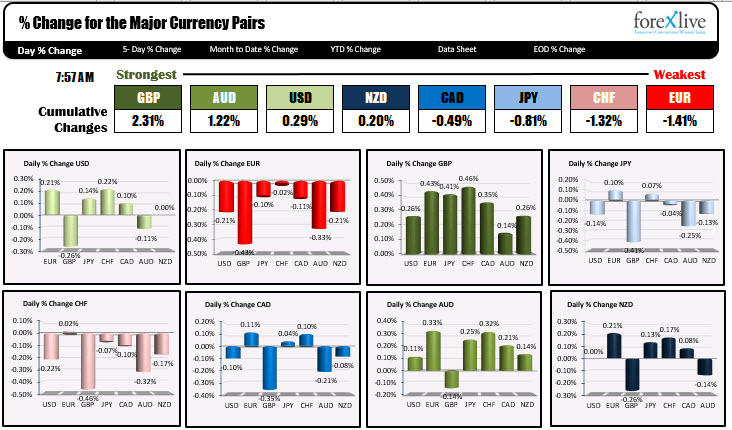

The GBP is the strongest and the EUR is the weakest as NA traders enter. The Eurogroup members failed to agree on financing for the unions fiscal response. The failure to agree is putting some pressure on the EUR today. The GBP is the strongest, but the gains are relatively modest. THe USD is mixed in the morning snapshot with the greenback higher vs the EUR, JPY, CHF, CAD and down vs the GBP and AUD. It is unchanged vs the NZD.

The volatility is down in the forex market as indicated by the ranges in the lower chart below. Each of the major currency pairs and crosses are trading well below their 22 day averages. The JPY pairs moved lower earlier in the day, but have rebounded with the GBPJPY leading the way (up 55 pips). The USDCAD has given up earlier gains and trades back toward unchanged on the day (up 14 pips after being up around 90 pips at the high).

In other markets:

- spot gold is down about $2 or -0.13% $1645.70

- WTI crude oil futures are up $0.50 or $2.03 at $24.11, however, the price is down from earlier highs at $25.29 and trades closer to the session lows at $24.04

In the premarket for US stocks the futures prices are higher and implying a higher opening:

- S&P index up 22 points

- NASDAQ index up 75 points

- Dow up 215 points

in the European equity markets indices are lower as it plays catch up to the declines seen in the New York afternoon session:

- German DAX -0.5%

- France’s CAC -1.1%

- UK’s FTSE 100 -0.9%

- Spain’s Ibex, -0.9%

- Italy’s FTSE MIB -0.5%

In the US debt market yields are up with the yield curve steepening. The 2-10 year spread is up 2.4 basis points to 47.65 from 45.21 at the close yesterday.

In the European debt market yields are mixed with investors shunning Italian 10 year notes (up 6.2 basis points). UK yields are down -2.1 basis points and France’s down marginally.